Cryptocurrency Tax Calculator Canada

When filling out your financial picture be sure to select I sold or traded cryptocurrency. Selling a cryptocurrency or digital asset for fiat currency is a taxable event.

Pin On Entrepreneur Motivation

The tax software for cryptocurrency can make accounting and reporting so much easier.

Cryptocurrency tax calculator canada. Capital losses may entitle you to a reduction in your tax bill. BearTax helps you to fetch trades from 50 crypto exchanges review and calculate capital gains or losses based on your transactions and auto-generates tax. BearTax is a trusted cryptocurrency tax software that makes the process of calculating filling and reporting taxes super easy.

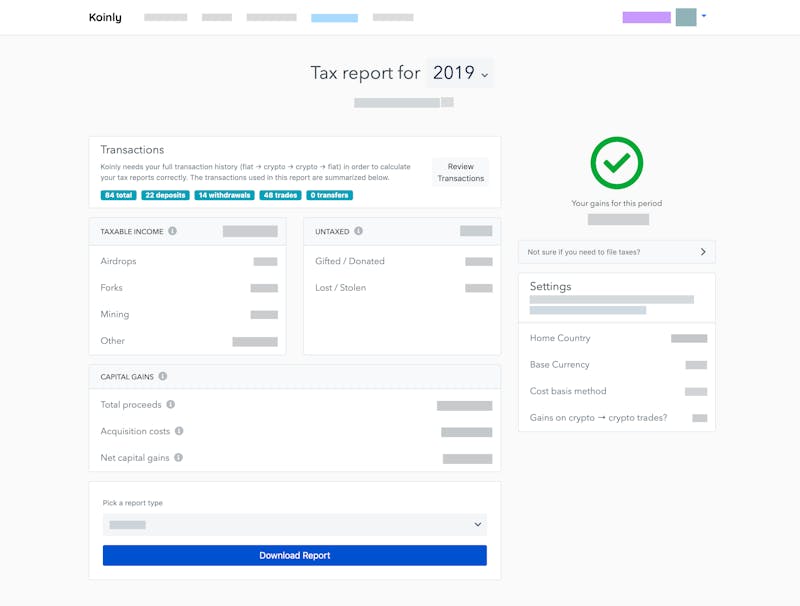

Koinly is a cryptocurrency tax calculator that helps you generate accurate and CRA-compliant capital gains reports which means you can file your crypto taxes with a lot more ease. Cryptocurrency Mining While mining cryptocurrency can at times be considered as a hobby its more likely that you are generating business income through your cryptocurrency mining. How do I calculate capital gains or losses on cryptocurrency.

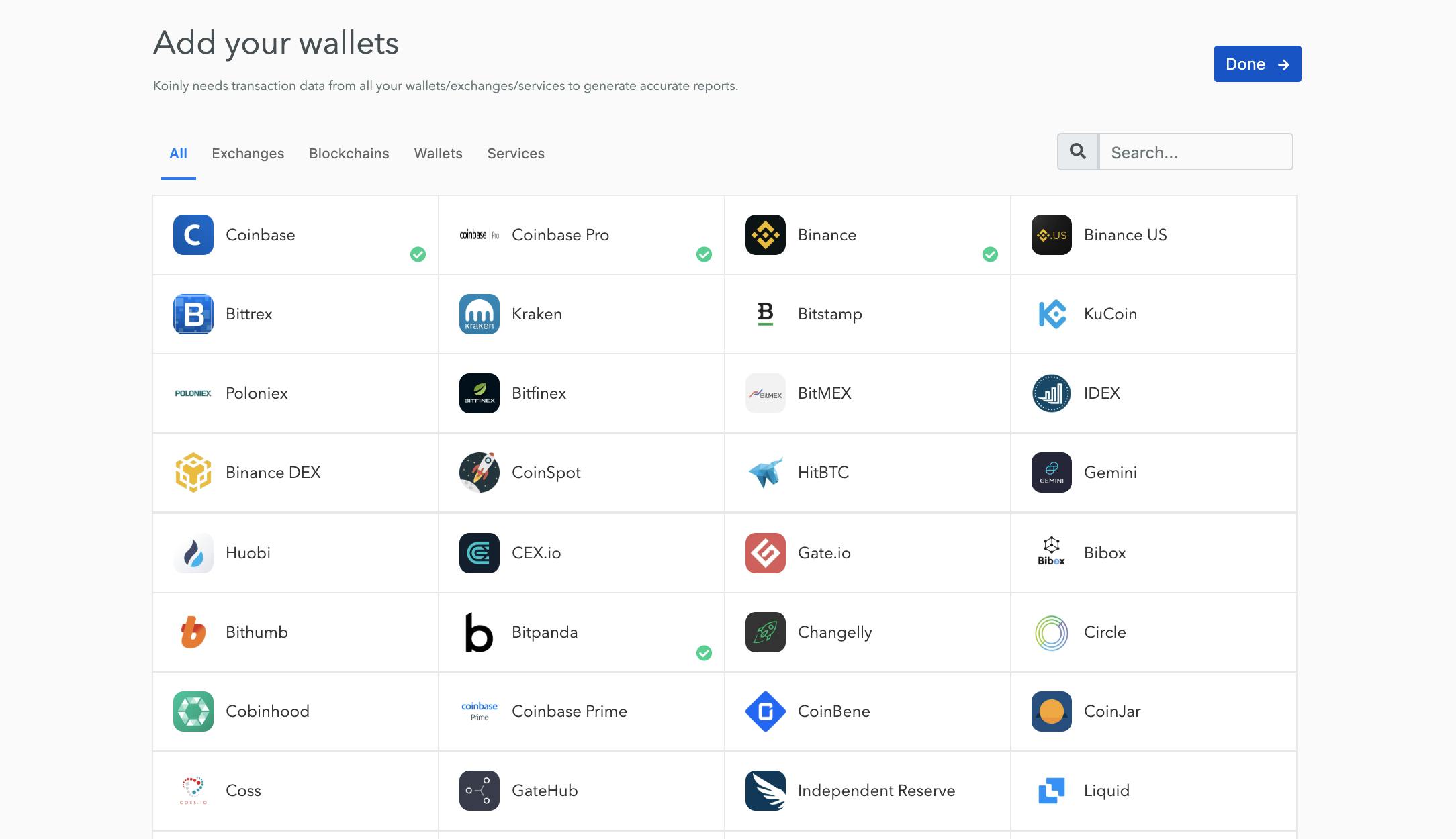

Koinly was built to solve this very problem - by integrating with all major blockchains and exchanges such as Coinbase Binance Kraken etc Koinly reduces crypto tax reporting to a few minutes of work. Anyone who owns multiple exchange accounts or wallets knows the pains when it comes to declaring taxes. The CRA says Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax Simply put.

This means that half of the money you earn from selling an asset is taxed and the other half is yours to keep tax-free. By collecting data calculating tax liability and creating reports the process of completing annual taxes with the accounting software will save time and money. With Koinly all you have to do to file your taxes is.

Bitcoin Tax Calculator for Canada. Below are the capabilities of cryptocurrency tax software. Lets say you bought a cryptocurrency for 1000 and sold it later for 3000.

To calculate the capital gains you need to first establish the cost basis for the cryptocurrency you are disposing of. Coinpanda is one of very few tax solutions that support Canada today at the time of writing. We offer full support in US UK Canada Australia and partial support for every other country.

CoinTracking analyzes your trades and generates real-time reports on profit and loss the value of your coins realized and unrealized gains reports for taxes and much more. Enter your taxable income excluding any profit from Bitcoin sales. Enter your states tax rate.

Once you have begun your return and filled out the initial prompts navigate to the Cryptocurrency tab by choosing Federal Wages Income Cryptocurrency. 50 of your crypto gains are added to your income and taxed at your marginal tax rate youre only being taxed on your investment gains not the entire value of your crypto holdings. The software connects to established cryptocurrency exchanges like Coinbase Bitstamp and others in order to track transactions in major cryptocurrencies such as BTC BCH ETH and a number of altcoins.

50 of the gains are taxable and added to your income for that year. Thats why most people use a cryptocurrency tax calculator like Coinpanda to handle this and generate all required tax reports and forms automatically. Select your tax filing status.

For most people this is the same as adjusted gross income AGI. Koinly is a cryptocurrency tax software for hobbyists investors and accountants. Select the tax year you would like to calculate your estimated taxes.

Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance. Seamlessly integrated with TurboTax and your accountants software. The Leader for Cryptocurrency Tracking and Tax Reporting.

The Senate reviewed the issue of taxation on cryptocurrency in 2014 and recommended action to help Canadians understand how to comply with their taxes which the Canada Revenue Agency CRA is doing by presenting this guide. Connect your exchange accounts and. You are liable for capital gains tax on the amount if any that your original holding appreciated in value since you bought it.

Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations. Crypto taxpayers can use the Libra Tax calculator for free for up to 500 transactions while the paid subscription allows them to track 5000. Because of this challenge a lot of Canadian cryptocurrency users are using cryptocurrency tax calculators to automate the entire tax reporting process.

You can sign up for a free account and download your tax reports in under 20 minutes. You would have to report a capital gain of 1000 50 of 2000 which would be added to your income and taxed at your marginal tax rate. Easily review your tax summary and download the reports you need to file your taxes.

Cryptocurrency is taxed like any other commodity in Canada. In Canada you need to use Adjusted Cost Base ACB which is simply the average purchase cost of all coins you have in possession. With the prices for 10162 coins and assets youll always have a complete overview.

In Canada you only pay tax on 50 of any realized capital gains.

Blog Crypto Tax Calculator Calculate Your Tax Obligation In Seconds Zenledger

Track Your Cryptocurrency Portfolio Taxes Cointracker Is The Most Trusted And Secure Cryptocurrency Portfolio Tr Tax Guide Cryptocurrency Buy Cryptocurrency

Declare Your Bitcoin Cryptocurrency Taxes In Canada Cra Koinly

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Koinly Bitcoin Tax Calculator For Canada

Crypto Tax Calculator Doing Your Crypto Taxes Has Never Been Easier Boinnex

Koinly Bitcoin Tax Calculator For Canada

Calculate Bitcoin Taxes For Capital Gains And Income Capital Gain Bitcoin Ways To Earn Money

Bitcoin Tax Calculator India Bitcoin Transaction Bitcoin Startup Company

Pin By Starter Story Learn From Succ On Idea Inspiration Incentive Free Plan Cryptocurrency

Calculating Crypto Taxes In Canada With The Superficial Loss Rule Koinly

How To Exchange Bitcoin For Cash Bitcoin Startup Company Ways To Earn Money

Crypto Com Tax The Best Free Crypto Tax Bitcoin Tax Calculator

Koinly Bitcoin Tax Calculator For Canada

Coinbase Releases Tax Calculator But Many Users Will Likely Not Qualify Capital Gains Tax Paying Taxes Capital Gain

Bitcoin Price Target Bitcoin Direct Deposit Cryptocurrency Banner Bitcoin Marketcap Bitcoin Mining Shares 1 Bit Bitcoin Cryptocurrency What Is Bitcoin Mining

Canadian Crypto Tax Calculator

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Blog Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

Post a Comment for "Cryptocurrency Tax Calculator Canada"